jersey city property tax phone number

Construction Code 201 547-5055 9am - 430pm Mon - Fri City Hall Annex 1 Jackson Square Jersey City NJ 07305. City of Jersey City PO.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

To 530 pm except State holidays.

. COVID-19 is still active. TAXES BILL 000 0 000 2022 2. You may also print a copy of your tax bill by using the Property Tax Search and Payment.

You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Jersey City NJ 07305. Eduardo CToloza CTA City Assessor.

The City of Jersey City is Located in the state of NJ. THE OFFICE OF THE CITY ASSESSOR SHALL. For more information please contact the Assessment Office at 609-989-3083.

Online Inquiry Payment. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. For your convenience property tax forms are available online at our Virtual Property Tax Form Center.

Description The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation. TAXES BILL 000 000 1000 0 000 2035 1. Cultural Affairs 201 547-6921 9am - 5pm Mon - Fri 280 Grove Street Room 105 Jersey City NJ 07302.

Online Inquiry Payment. Covid19njgov Call NJPIES Call Center. If you need more information you may contact us at 609-989-3070.

When contacting City of Jersey City about your property taxes make sure that you are contacting the correct office. Property Tax Payment Due. Jersey City Tax Collector Contact Information.

Contact Contact name Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm Address Taxes enquiry desk at Customer and Local Services Philip Le Feuvre House La Motte Street St Helier Jersey. Get driving directions to this office. Inquire as to the status of an Inheritance or Estate Tax matter.

Tax Sale of 2022 and prior year delinquent taxes and other municipal charges through an online auction on. City Hall 280 Grove Street Room 116 Jersey City NJ 07302 Tel. Jersey City Tax Collector Contact Information.

Taxes for 2022 are due FEBRUARY 1 ST MAY 1 ST both. To 530 pm except State holidays. 11 rows City of Jersey City.

The City of Jersey City is Located in the state of NJ. Remember to have your propertys Tax ID. The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property taxes.

In Person - The Tax Collectors office is open 830 am. Hillsborough Township is part of Somerset County located in the center of New Jersey. City of Jersey City.

Information can be viewed free of charge beginning May 23 2022. The township is situated 52 miles from Manhattan and 55 miles from downtown Philadelphia. 515 S FLOWER ST 49TH FL Bank Code.

Contact Us 908 369-4313. Jersey City is a municipality inHudson County and each of the municipalities here deals with taxes differently. Account Number Block Lot Qualifier Property Location 638 14503 00003 53 ESSEX.

11605 00001 Principal. 1 Nov Property Tax Payment Due. Senior Freeze Property Tax Reimbursement Information Line - 1-800-882-6597 within NJ NY PA DE and MD.

1 Feb Property Tax Payment Due. Address Phone Number Fax Number and Hours for Jersey City Tax Collector a Treasurer Tax Collector Office at Grove Street Jersey NJ. Office hours are Monday through Friday 830 am.

By Mail - Check or money order to. JERSEY CITY NJ 07302 Deductions. Tuesday June 21 2022 at 900 AM.

If you do not receive a tax bill in the mail by the second week of November please contact our office at 502-574-5479 and request a duplicate bill to be sent to you. Inheritance and Estate TaxService Center 609-292-5033. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

For more information please contact the Assessment Office at 609-989-3083. City of Union City. Planning Historic Preservation Payments.

Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. Homestead Benefit Hotline - 1-888-238-1233 within NJ NY PA DE and MD Get program information from a Division representative. Name Jersey City Tax Collector Address 280 Grove Street Jersey New Jersey 07302 Phone 201-547-5125 Fax 201-547-4254 Hours Mon-Fri 800 AM-800 PM.

Have Inheritance and Estate Tax forms mailed to you. Stay up to date on vaccine information. Parking Moving Violation Tickets.

TAXES BILL 000 000 0 000 2022 2 4292022. 04403 00034 Principal. Property Tax Payments and Installment Plans 609-989-3058.

1-800-882-6597within NJ NY PA DE and MD Office hours are Monday through Friday 830 am. Box 2025 Jersey City NJ 07303. City of Jersey City.

Jersey City NJ 07302. There is a lot to know when it comes to owning a home and.

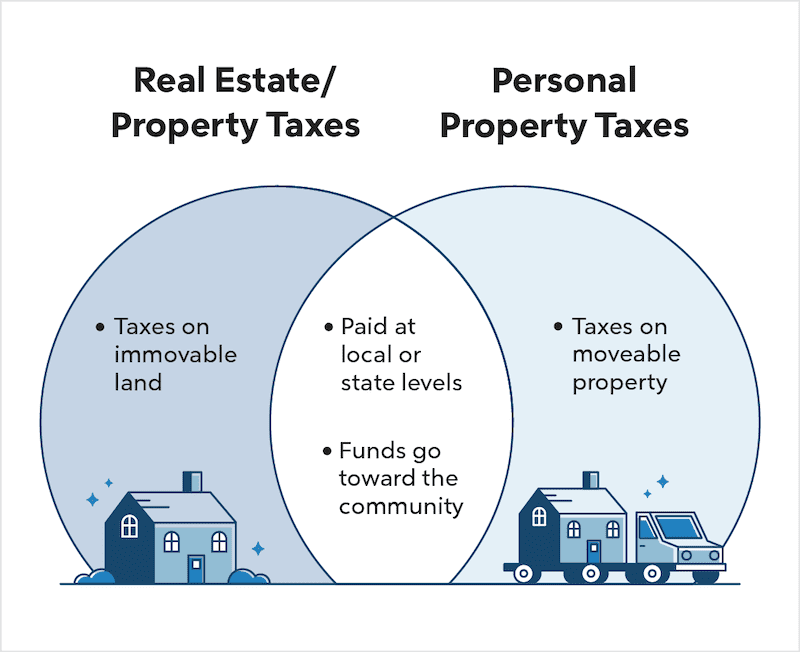

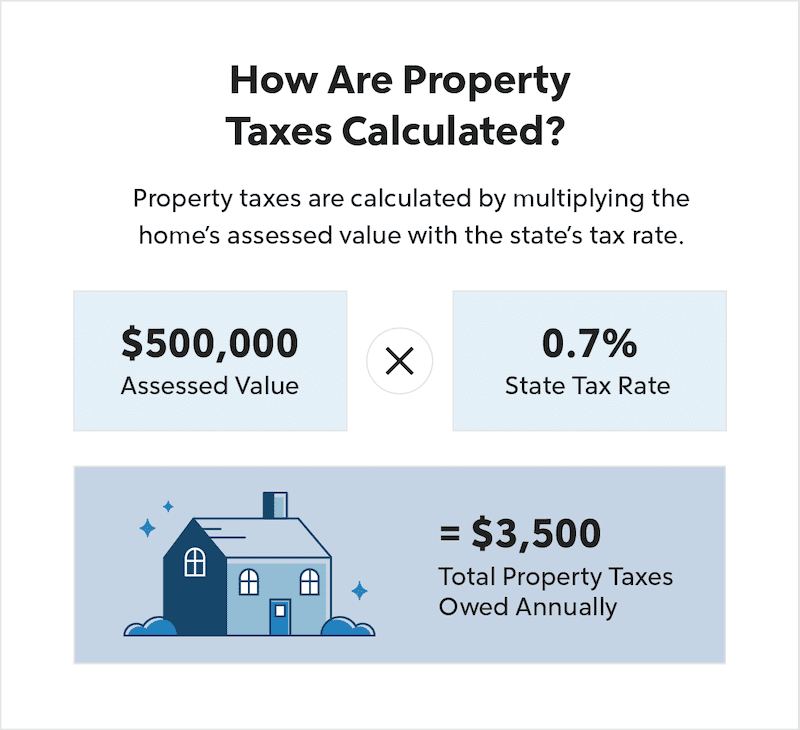

Real Estate Taxes Vs Property Taxes Quicken Loans

State Local Property Tax Collections Per Capita Tax Foundation

New Jersey Quit Claim Deed Form Quites New Jersey Words

Official Website Of East Windsor Township New Jersey Tax Collector

Latest News The Town Of Kearny Nj Kearny Ferry Building San Francisco Jersey City

Real Estate Taxes Vs Property Taxes Quicken Loans

Tax Information City Of Katy Tx

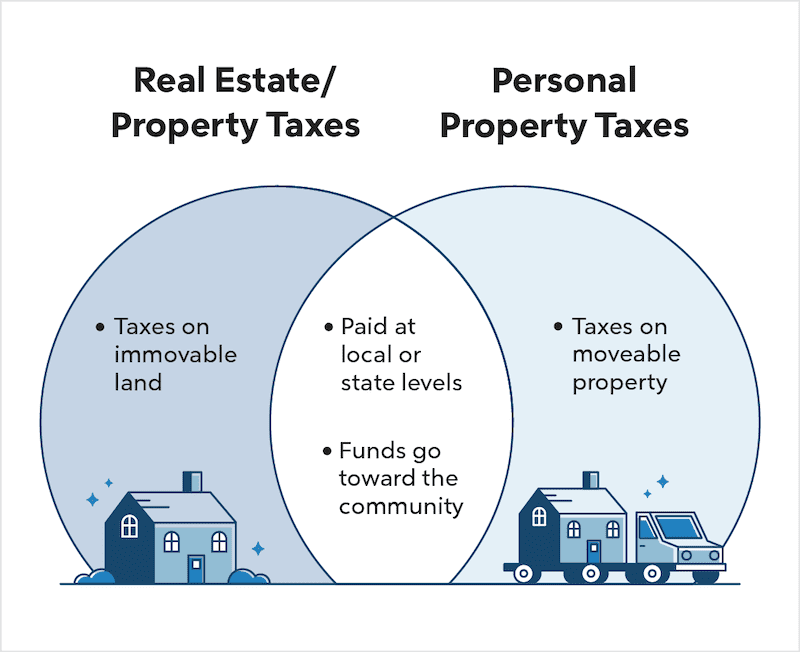

Freehold Township Sample Tax Bill And Explanation

The Official Website Of City Of Bayonne Nj Tax Collection

Civic Parent Getcivic With Financial Literacy

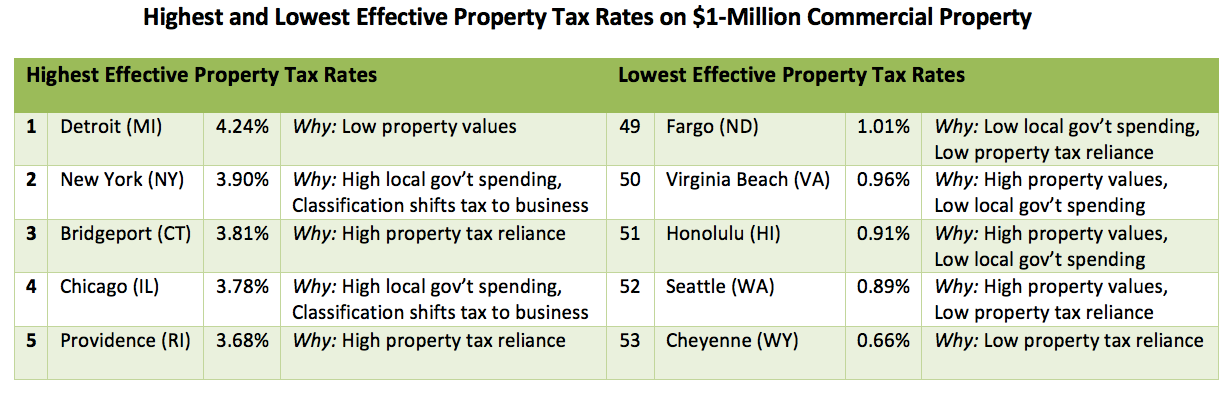

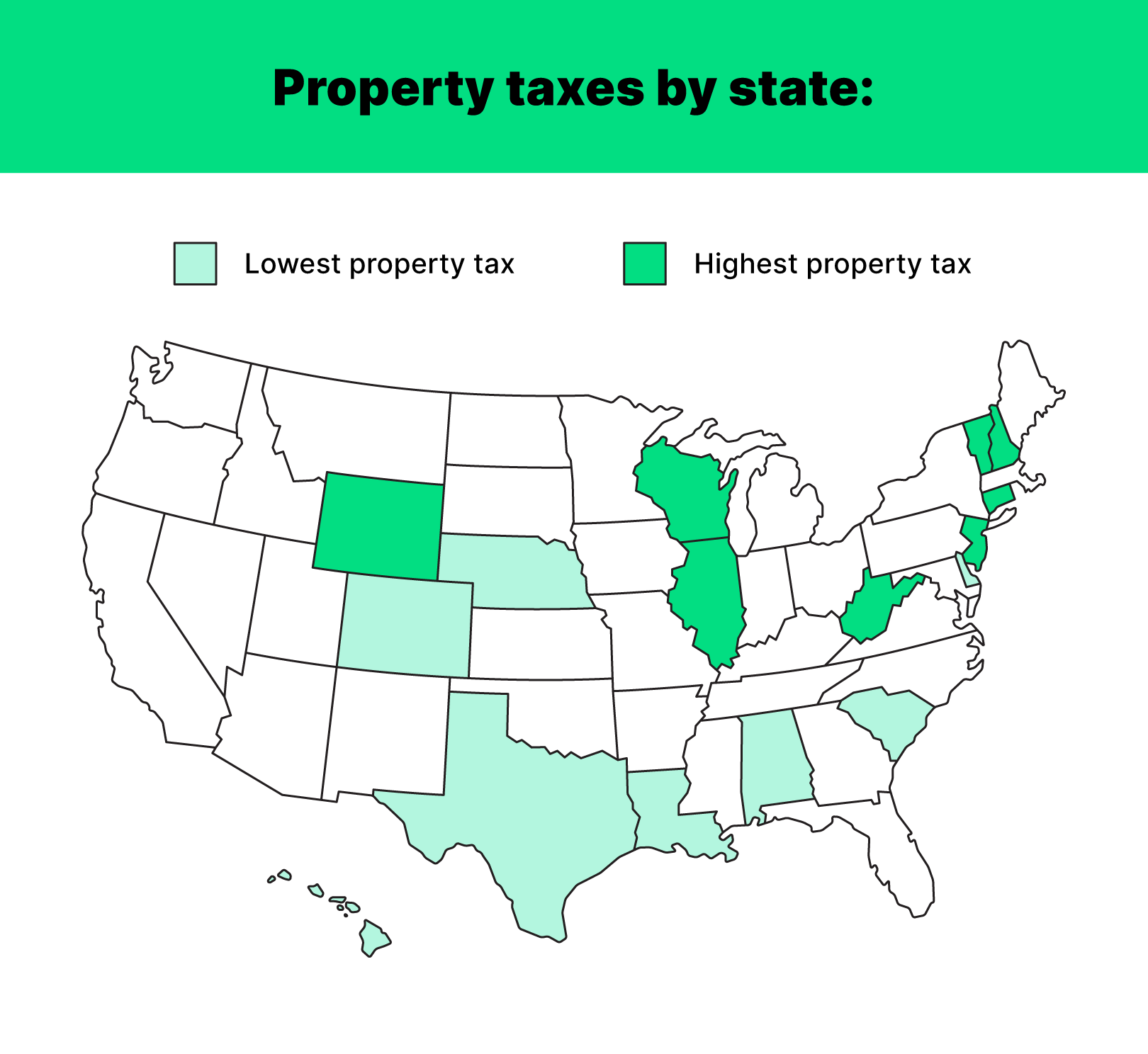

States With The Highest And Lowest Property Taxes Property Tax Tax States

Orange County Ca Property Tax Calculator Smartasset

Why Identical Homes Can Have Different Property Tax Bills Lincoln Institute Of Land Policy

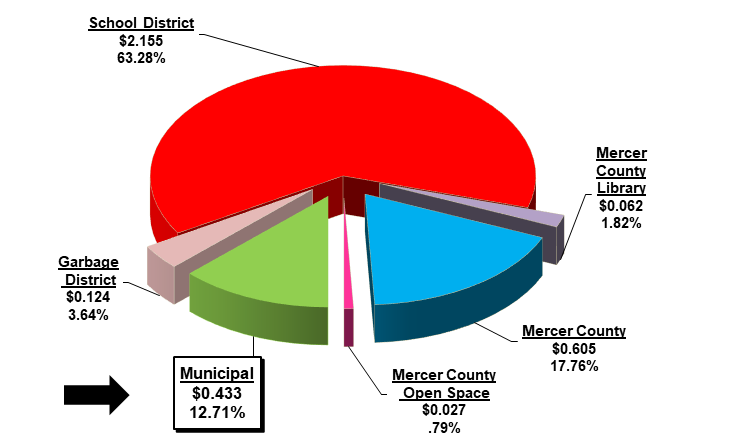

Your Guide To Property Taxes Hippo

Budget Info Graphic Budgeting Infographic Franchise Fee

Back Tax Help Johnson City Tn 37601 M M Financial Blog Tax Help Back Taxes Help Irs Taxes

Work Starts On Tallest New Jersey Tower By Hwkn And Handel Architects Skyscraper Architecture Building Skyscraper

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)